How Does Cash App Work | Quick Tutorial for Beginners

Cash App works by linking your bank account or debit card to send and receive money instantly. You can add cash, pay others using a $Cashtag, spend with the Cash Card, or invest in stocks and Bitcoin.

Cash App is a leading U.S. mobile payment service developed by Block, Inc. (formerly Square). It functions like a digital checking account, allowing users to send, receive, and store money directly from their smartphones.

While not a bank itself, Cash App partners with FDIC-insured banks to hold customer funds and provide financial services. Beyond simple peer-to-peer payments, it offers direct deposits, a free Visa debit card (the Cash Card), instant transfers, and beginner-friendly investing in stocks and Bitcoin.

Related Read For More Information:

- What Is Cash App Bank Name and Address | Set Up Direct Deposit

- How To Add Someone on Cash App: Step-By-Step Tutorials

- How to Add Money to Cash App

- Does Cash App Accept Credit Card Payments?

- Where Can I Load My Cash App Card | 15 Participating Stores & Fees

- How to Use Cash App?

Getting Started: Setting Up Your Cash App Account

Here’s How to Set up a Cash App account:

- Download and Sign Up

Install Cash App on your iPhone or Android device. Open the app, enter your phone number or email, and verify with the code sent to you.

- Link Your Bank Account

Add a debit card or bank account under the Banking tab. Cash App does not support credit cards for adding funds.

- Create Your $Cashtag

Choose a unique username (your “$Cashtag”), which other users will use to send you money.

- Minimum Age Requirement

You must be at least 18 years old to open an account. Teens aged 13–17 can access Cash App with a parent or guardian’s approval through a sponsored account.

Once your profile is set up, you can start sending and receiving money immediately.

A linked bank account is optional, but it enables deposits, withdrawals, and faster transfers.

Verifying Your Identity

Cash App limits unverified accounts to small transfers, typically $250 per week for sending and $1,000 per month for receiving.

To remove these limits, verify your identity by providing your full name, date of birth, and the last four digits of your Social Security Number. Verification also unlocks features such as the Cash Card, stock and Bitcoin investing, and higher transfer limits.

After verification, users can typically send up to $10,000 per week and receive $25,000 per month, depending on account activity.

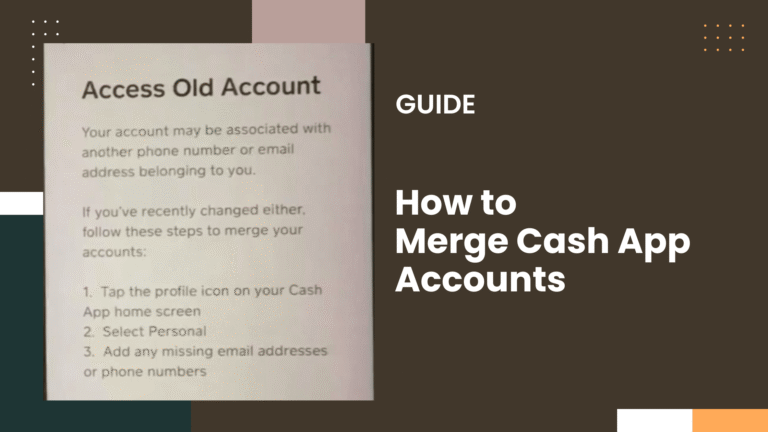

How to Verify Your Identity on Cash App

1. Open the Cash App

Launch the app and tap your profile icon (top right corner).

2. Select “Personal”

Scroll to the Personal section under the Account menu.

3. Provide Personal Information

Cash App will prompt you to enter the following details:

- Full legal name

- Date of birth

- Last four digits of your Social Security number (SSN)

- Mailing address

4. Submit and Wait for Approval

After you provide your details, Cash App typically reviews your information within 24 to 48 hours. You’ll receive a notification once your account is verified.

How to Link Bank Accounts to your Cash App?

Once your account is active, link a debit card or bank account to fund transactions.

To add money:

- Tap the Banking tab on the home screen.

- Choose “Add Cash”, select an amount, and confirm with your PIN or Face ID.

Deposits usually complete within 1–3 business days.

You can also fund your Cash App balance by:

- Receiving direct deposits (paychecks or benefits).

- Adding cash at retail partners like Walgreens or Walmart for a $1 flat fee per deposit.

How to Send and Receive Money?

To send money:

- Enter the amount,

- Tap “Pay,” and

- Select the recipient by their $Cashtag, phone number, or email.

Transactions from your Cash App balance or debit card are free; using a credit card adds a 3% fee.

To receive money:

Share your $Cashtag or simply tap “Request.”

Funds arrive instantly in your Cash App balance and can be spent, transferred, or withdrawn.

Caution: Cash App payments are instant and typically non-refundable. Always confirm recipient details before sending.

How to Manage Your Cash Balance and Transfers

Money received stays in your Cash App balance until you withdraw or spend it.

- Cash Out: Tap Banking → Cash Out to move money to your bank.

- Standard transfer: Free, 1–3 business days.

- Instant transfer: Arrives within minutes for a 0.5%–1.75% fee.

Notifications track every deposit, withdrawal, or card transaction in real time.

How to Order a Cash Card and Customize it?

The Cash Card is a free Visa debit card linked to your Cash App balance.

- Open Cash App: Launch the Cash App on your iPhone or Android device.

- Go to the “Card” Tab: Click on Card icon on the home screen. This section manages all card-related features.

- Select “Get Free Cash Card”: You’ll be prompted to choose your design next.

- Customize Your Card (Optional): Before confirming your order, you can personalize your Cash Card with design options (see next section).

- Provide Required Details: Enter or confirm your full legal name, mailing address, and date of birth. Cash App may require identity verification (last four digits of your SSN) before proceeding.

- Confirm and Order: Review your design and shipping details, then tap “Order Card.”

- Delivery Time: Physical cards typically arrive within 7–10 business days. While you wait, you can instantly add your virtual Cash Card to Apple Pay or Google Pay and start using it right away.

ATM Fees: About $2–$2.50 per withdrawal, though users with $300+ in monthly direct deposits get three ATM fee refunds per month.

How to Activate your Cash Card?

Once your card arrives:

- Open Cash App → Tap “Card” tab

- Select “Activate Cash Card”

- Scan the QR code that came with your card, or manually enter the CVV and expiration date.

Cash App Direct Deposit and Account Numbers

Each Cash App account includes a unique routing and account number, allowing users to receive paychecks, tax refunds, or government payments.

Direct deposits are free and may arrive up to two days early compared with traditional banks. The service supports up to $25,000 per deposit and $50,000 per day.

Is it Possible to buy Bitcoin and Stocks On the App?

Cash App also supports investing, a streamlined feature aimed at first-time investors.

- Stocks and ETFs: Buy fractional shares with as little as $1 and no commission fees.

- Bitcoin: Buy, sell, or send Bitcoin directly in-app. Cash App charges a small variable fee, shown before confirmation.

- Withdrawals: Verified users can transfer Bitcoin to external wallets if desired.

Fees and Limits

| Service | Fee | Notes |

|---|---|---|

| Sending/Receiving (via balance or debit) | Free | Credit cards incur 3% fee |

| Instant Transfer to Bank | 0.5%–1.75% | Min $0.25 per transfer |

| Standard Transfer | Free | 1–3 business days |

| ATM Withdrawal | $2–$2.50 | Refunded with $300+ direct deposits |

| Cash Deposit at Retail Stores | $1 flat fee | May vary by store |

| Monthly/Account Fees | None | No minimum balance required |

Is Cash App Secure and Safe?

Cash App uses encryption, real-time fraud monitoring, and optional PIN or biometric locks for every transaction. You can instantly disable a lost Cash Card in the app.

Because payments are instant, Cash App cannot reverse transactions automatically; only the recipient can refund them. Always verify recipients before sending.

Extra Features

- Cash Boosts: Activate merchant discounts to save on everyday purchases.

- Direct Deposit Perks: Access paychecks early and qualify for overdraft protection.

- Cash App Taxes: File federal and state returns for free directly in the app.

- Multi-Device Access: Use Cash App on your phone or sign in via the web for convenience.

So, Should U Use the App?

Cash App combines modern payments, light banking tools, and beginner-friendly investing in one clean mobile app. It’s ideal for quick peer-to-peer transfers, managing paychecks, and basic stock or Bitcoin investing, all with no monthly fees.

Keep your account secure with Face ID or PIN protection, and always verify before sending money. With a few simple steps, even beginners can confidently use Cash App as their everyday money app.

Personally i use the app and i think if you follow strict safety measures, its the one to go for.